Digital Adoption in Insurance: Best Practices & Challenges

- Published: March 12, 2024

- Updated: April 4, 2024

Technology is bringing new efficiencies for all areas of the insurance space, from chatbots boosting customer engagement to IoT sensors improving the understanding of risks. However, poor digital adoption in the insurance sector hinders these benefits.

Outdated infrastructure, data silos, underskilled employees, talent shortages, and fixed processes can present significant roadblocks to innovation. However, sticking with the current state of operations isn’t an option. Insurers now face a choice between digital transformation or decline, as digital access in the insurance industry has increased 30% post-COVID.

This article explores digital adoption in the insurance industry. It looks at how technology is changing operations, services, and access to information. The focus is on the importance of digital adoption and its challenges. We’ll examine ways to increase adoption and digital transformation in insurance success.

The Importance of Digital Adoption for Enterprise Insurance Companies

Insurance executives overwhelmingly agree on accelerating digitization, with 89% calling for an industry overhaul. However, only 44% have driven any meaningful change so far. This gap is one that insurance companies can’t afford to ignore, as digital adoption comes with impactful business benefits, including:

1. Maintaining competitiveness

As Insurtech disruptors threaten to take market share, digital adoption has become even more critical. GenAI, predictive insurance analytics, cloud computing, and IoT sensors allow established insurers to keep pace by developing innovative products and hyper-personalized pricing models based on customer insights.

Rather than reacting to shifting demands, analytics tools empower insurers to proactively predict trends and customize offerings. Access to real-time information also supports the agility insurance companies need to test and refine their innovations.

2. Enhancing customer experience

Policyholders expect on-demand experiences, tailored offerings, and communication across channels. Mobility and automation enable insurers to provide 24/7 support and speed up digital claims.

Insurers must bring digital convenience and care together to demonstrate their commitment to customers as individuals. Companies that infuse technology with the emotional intelligence of their staff will set the customer experience standard.

3. Operational efficiency

Sprawling systems stop insurers from reaching their full potential and providing the best possible experience for all parties. By connecting siloed functions, insurers gain end-to-end visibility to optimize workflows and resources.

A McKinsey survey done with US agents found that 44% of agents rated digital tools or customer tools as the number one capability insurers can invest in to support them. Employees want to use these tools to improve their workflows.

As a result of the suitable systems and support, processes can smooth out internally. The ripple effects reach customers through faster response times, more accurate risk assessments, and lower premiums. It’s a win-win. Customers get what they need quickly. Insurance companies can better manage both productivity and costs.

Connecting the Dots: Digital Adoption and Insurance Enterprise Success

Digital transformation and adoption aren’t buzzwords in our current landscape. Insurance technology spending in the US and the UK is expected to grow by more than 25% between 2022 and 2026.

Digital capabilities help insurance companies meet the rapid pace of change across the sector. All to promote and sustain innovation from the back-end to the customer-facing front-end. According to Deloitte’s 2024 global insurance outlook, most insurers are realizing that reacting to risks may not be good enough and are undertaking transformation efforts aimed at preventing losses from happening in the first place.

Enterprises that take on digital adoption initiatives are better equipped to face challenges, capitalize on new opportunities, and meet the expectations of both customers and stakeholders in an increasingly digital world.

Top Technology Adoption Challenges Facing Insurance Organizations

Achieving digitalization success is easier when you understand everyday technology adoption challenges. Here are a few of the most critical challenges for insurance tech adoption and what you can do to overcome them.

1. Contextual end-user onboarding and training for employees and policyholders

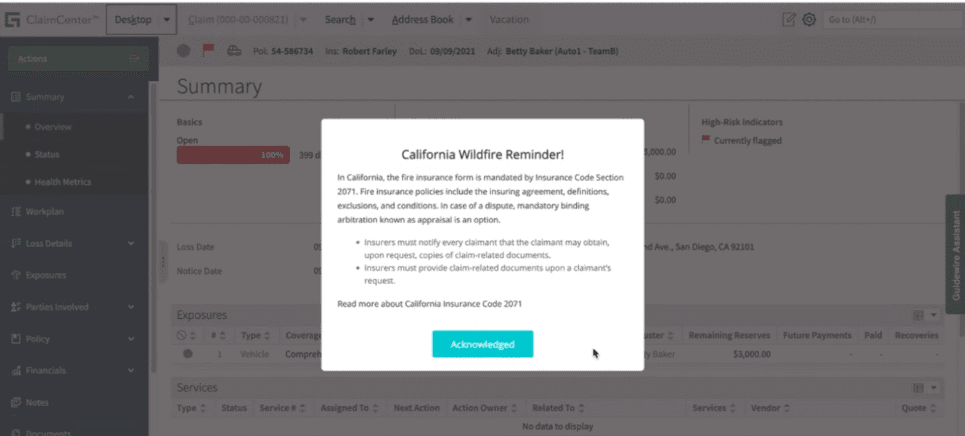

Implementing new technologies in insurance requires thoughtful onboarding across end-user roles. Agents, claims adjusters, and policyholders interact with systems differently based on their roles. Providing tailored, role-based training and support that aligns with these unique needs is crucial for driving adoption.

Customized walkthroughs, in-app tooltips, and role-based tutorials enable employees to use internal digital processes and new tech. Insurance companies also must invest resources into contextual, guided policyholder onboarding for new online user portals and self-service centers.

Taking this high-touch, personalized approach makes it easier for people to embrace change which will maximize return on technology investments. As insurers continue legacy application modernization efforts, contextual onboarding sets each user up for success and separates true transformation from temporary use.

2. Reliance on legacy systems

For many insurers, innovation is constrained by outdated legacy systems deeply embedded into existing operations. While modernizing is essential, change poses operational risks if not done correctly.

For effective tech implementation that drives end-user adoption, platforms help bridge old and new environments to maintain continuity. Insurers must work within their barriers and approach change adoption one step and system at a time.

3. Transitioning offline processes to digital workflows

Transitioning away from manual processes requires understanding existing workflows before digitizing. Insurers can pinpoint high-impact opportunities by mapping out current procedures with input from team members. Involving end users in this way also helps to promote excitement about upcoming changes.

Digitized workflows improve productivity, consistency, and insights when aligned with user needs. For insurers facing intensifying competition, successfully upgrading from analog to automated is the key to keeping up.

4. Complexity of insurance technology implementation

Implementing advanced insurance technologies involves navigating technical and organizational puzzles. Integrating systems demands meticulous planning to enable a seamless data flow while upholding security and compliance.

Then, there’s the challenge of change management. The questions are: How do you get the technology in place and convince the entire organization that implementing it is worth the time and effort? Planning infrastructure changes must be followed up with plans for a polished roll-out.

5. Providing on-demand end-user support

Insurance digital adoption doesn’t only include tasks you complete one time. It’s an ongoing collaboration with end-users requiring constant reinforcement learning and performance support. Frictionless integration relies on responsive support systems that continue building confidence over time.

For example, instant self-help options empower users to find answers when needed. With the proper end-user support, technology users can more easily get up to speed on new processes through contextual assistance. This makes adoption and transformation a core piece of business culture.

6. Identifying areas of end-user friction

End-user challenges go hand in hand with insurance technology adoption. The most significant factor contributing to policyholder dissatisfaction was “hard-to-use” tools and lack of self-serviceability. Methods for gathering user feedback, analytics, and usability testing help pinpoint friction that impacts engagement.

These insights allow insurers to remove user barriers drive satisfaction, build confidence with digital tools, and get more value from modernization efforts. By tracking digital experience gaps, insurance leaders can improve their guidance and training.

How to Enable End-Users and Achieve Insurance Technology Adoption With DAP (Digital Adoption Platform)

Looking for specific ways to make your digital adoption in the insurance sector a success? Here’s what organizations can do to make the adoption and transformation process easier for end users.

1. Provide contextual onboarding and training

Digital adoption platforms (DAP) revolutionizing insurance tech adoption by empowerring end-users with contextual onboarding via in-app guides and personalized learning paths tailored to each learner’s role and skill level. Consider a new insurance agent logging on and immediately receiving a customized interactive walkthroughs of their tasks and a guided tour of the core platform features. This contextual approach ensures users learn by doing instead of passively consuming generic materials.

DAPs like Whatfix adjust real-time training based on end-user role, progress, and trouble areas, making skill-building efficient and engaging. For example, if users run into a common navigation issue, they can get the guidance they need. By providing the proper knowledge at the right time, DAPs empower employees and customers to easily work through learning curves.

2. Enable end-users with moment-of-need support

Users often need quick help overcoming roadblocks without losing momentum. DAPs like Whatfix delivers by providing in-workflow tips and self-help resource centers. For example, if an adjuster hesitates on a complex claims form, a personalized tip can instantly clarify the requirements to unblock progress. By integrating this assistance, DAPs promote user independence, satisfaction, consistency, and accuracy.

With Whatfix, create in-app support like Tours, Task Lists, Flows for interactive walkthroughs, and more that provide moment-of-need support for insurance professionals during their work and customers navigating new tools.

With Whatfix Self Help integrates with your process documentation, training resources, video tutorials, help articles, SOPs, scripts, FAQs, knowledge base, and more – enabling employee and customer end-users with support at the moment of need.

3. Keep end-users updated on changes

As insurance technologies advance, keeping users updated on new features and process changes is essential, but challenging. DAPs meet this need through timely in-app notifications to share release notes, functionality upgrades, and more. All without disrupting workflows.

For example, a Pop-Up can alert claims managers about a new validation or process change and provide a quick start tutorial. Strategic DAP alerts keep the entire insurance workforce in sync with system changes.

4. Analyze end-user behavior for continuous improvement

DAPs like Whatfix add value by revealing how end-users interact with technology. End-user analytics can help you identify behavior patterns, pain points, and underutilized features. With this data, insurers can streamline digital platforms to better align with user preferences, manage adoption barriers through tailored training, and predict needs.

Continuous optimization driven by DAP insights also ensures that as consumer expectations evolve, the digital tools serving them do too. That way, enhancing user experiences and improving organizational agility feed into each other.

With Whatfix, track and analyze and end-user action with User Actions. This uncovers areas of end-user friction, maps user flows, builds user cohorts, and more. Use this data to create new in-app guidance and end-user support content, as well as continuously optimize and test new workflows and features.

5. Collect end-user feedback with in-app surveys

End-user perspectives offer invaluable direction for enhancing digital tools. DAPs like Whatfix support this feedback loop with in-app surveys and forms gathering user suggestions in their workflow. This convenience incentivizes participation, guiding refinements and new features.

Whether someone reports software bugs, requests for new capabilities, or feedback on onboarding experiences, this user input shapes a digital experience that aligns with real needs. Over time, direct user communication can lead to a community where customers and employees co-create better tech solutions based on end-user feedback.

6. Manage software subscriptions and licenses efficiently

According to Productiv, the average SaaS spend per employee in 2023 was projected to be almost $10K, while 53% of SaaS licenses go unused.

Managing several insurance software subscriptions can be challenging, but SaaS management platforms like Whatfix Enterprise Insights provide clarity into your software subscriptions and usage. By revealing end-user adoption rates for each solution, insurers can right-size investments to balance access with responsible spending, reduce SaaS waste, and optimize their digital strategy.

This helps cut overspending on unused tools without hindering employee productivity. With end-to-end visibility into usage trends and user sentiment, insurance finance and tech leaders can get more value by adding, upgrading, or retiring solutions as needed. The result is an increasingly optimized digital toolbox purpose-built for user needs.

How Sentry Uses Whatfix to Enable End-Users and Drive Application Adoption

How might a DAP work for your insurance organization? Let’s look at Sentry Insurance, who partners with Whatfix’s DAP platform to support its digital transformation and end-user adoption initiatives.

Market shifts, changing customer expectations, and a new wave of insurance disruption required Sentry to act fast to support its digital strategy and enable its end-users. Associates need customer, policy, claim, and other data at their fingertips to deliver a great customer experience, respond quickly to claims, and find untapped growth opportunities.

Sentry used traditional methods and simple tools to point Sales, Customer Service, and Claims teams to training resources. The organization needed to provide a better experience to stakeholders and improve efficiency. After careful evaluation, Sentry selected a Whatfix digital adoption and experience layer to create a unique digital adoption experience for their end-users and stakeholders.

With Whatfix, Sentry Insurance is building personalized, in-app learning across critical insurance management and people applications. People can focus more time on new insurance sales opportunities, processing claims, and managing insurance policy inquiries.

The benefits included:

- Drove overall insurance business growth: In only 12 months, time-savings for content designers, developers, customers, and support staff totals more than $950,000 in resources, salaries, and re-gained productivity. Sentry can re-focus that value toward revenue-generating activities instead of the training content creation overhead.

- Reduced training content creation time by 40%: With Whatfix, it takes around 20 hours to create an item of content, compared to up to 50 hours previously. These time-savings add up rapidly – one Sentry application can have 500+ training content items.

- Delivered significant reduction in employee training time: Whatfix enables agents and other staff to use the applications without leveraging webinars or instructor-led sessions.

- Increased employee productivity: Sentry staff are proficient sooner in multiple customer and back office applications, working smarter in a hybrid work environment.

- Reduced policy and claims processing errors: Employees can easily catch policy and other mistakes with just-in-time nudges. Whatfix identifies and corrects errors inside the application with smart tips. Automated data input drastically reduces user errors.

Accelerate your insurance digital transformation by enabling your employees and policyholders with contextual in-app guidance and constant real-time support with Whatfix’s digital adoption platform (DAP).

Whatfix empowers insurance IT teams with its no-code Visual Editor to create in-app, moment-of-need support and contextual guidance – all inside your insurance software applications and digital processes.

This reduces time-to-proficiency and achieves new levels of productivity and proficiency through better insurance technology adoption for all end-users, including customer-facing policyholders and internal employees across underwriters, claims agents, support staff, and more.

It also provides abilities for self-service, personalization, and guided user experiences for any application end-user – enabling end-users to use insurance technology, improving end-user productivity, and automating operations.

Whatfix empowers a data-driven approach by analyzing tech experiences with end-user behavioral analytics and event tracking. This identifies areas of friction in your insurance digital processes and tech experiences, allowing you to create optimal, contextual user journeys across various end-user segments.

With Whatfix, insurance IT teams can identify areas of friction causing issues and launch new in-app guided Flows, Smart Tips, and Self Help elements to guide and assist them with localized content that guides them through processes, driving workflow adoption and achieving business outcomes.

How does it work? Whatfix empowers enterprise insurance organizations to:

- Create in-app Flows and Task Lists that guide end-users step-by-step through digital processes and applications.

- Enable all end-users with Self Help, providing a searchable help wiki that connects to all your help and support documentation, FAQs, help desk articles, and more – that overlays on your applications’ digital UI.

- Notify end-users of process updates, compliance changes, team updates, deadlines, and more with Pop-Ups and Beacons.

- Provide contextual Smart Tips that give end-users timely information that nudges them to take the correct in-app action.

- Use Field Validation to ensure data is entered in full, in the correct format.

- Collect end-user feedback from end-users such as NPS, customer satisfaction surveys, staff training and onboarding feedback, and bug identification with In-App Surveys.

- Analyze end-user behavior with User Actions and Enterprise Insights by tracking custom in-app events to optimize user journeys, segment users into cohorts, identify areas of friction, and more.

With Whatfix, you can understand how your insurance technology is used and under-adopted by your employees, B2B customers, and end-user policyholders. This makes it easier to adjust software onboarding, training, support, and overall end-user adoption strategies—all to provide a seamless experience for every end-user that enables them with the right context and support to utilize new technologies and systems fully.

Thank you for subscribing!